Sharing the deck that helped us raise our $8.4M Series A at Sarwa, and the hard lessons that came with it.

I’ve previously shared our Series B deck. Now, I’m sharing our Series A with $8.4 million raised, led by KIPCO. Other participants included Shorooq Partners, Middle East Venture Partners (MEVP), DIFC, 500 Global, Hala, Vision Ventures, Saned, Hambro Perks, Phoenician Funds, Mindshift, ADIO/ADQ and angel investors.

It was a complex round, but looking back, one of the most formative chapters in Sarwa’s journey.

This wasn’t a “smooth process” story. It was messy. Exhausting. And at times, discouraging. It also lasted 12 months and taught me a lot.

So in the spirit of transparency, I’m sharing our Series A deck and unpacking what actually happened beyond the slides.

The hardest round we ever closed

We had just started building real traction, but fundraising at this stage felt like fighting on too many fronts at once.

Three things made this raise especially tough:

1. The structure was complex for venture deals

We did a 50 / 50 mix: half in cash, half in-kind from AUM transfers. It made strategic sense for us, but most VCs either found it odd or didn’t want a strategic this early. It killed momentum with funds that didn’t know how to evaluate it.

2. I tried to raise and build at the same time

Unlike later rounds, I didn’t go all-in. I kept one foot in fundraising and the other in operations. It wasn’t sustainable and exhausting. It pushed me to rethink how I led, how we delegated, and ultimately, helped shape the ownership & trust culture we have at Sarwa today.

3. I chased the wrong lead for too long

We bet everything on one potential lead. After months of talks, they offered to lead only if angels sold their shares at a discount, exclusively to them. They didn’t want to share the upside or bring others in. Our angels pushed back. The deal collapsed. We had to start from zero, again.

A few things I wish I had done better

Projections

We didn’t clearly spell out how we’d spend the money. The model was basic. We should have front-loaded it and made the story obvious.

Market depth

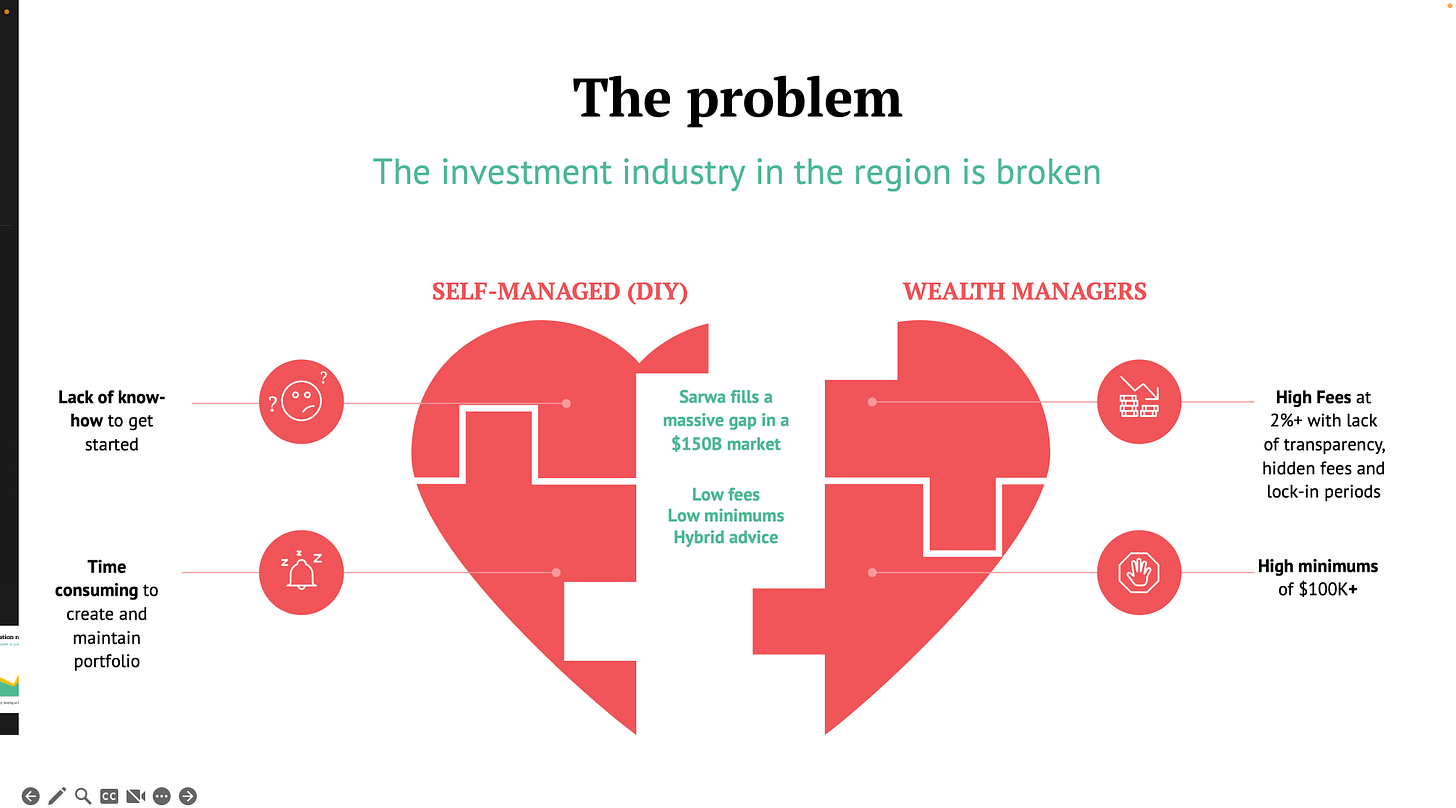

We were early in the MENA investing landscape, and our market sizing slides didn’t fully capture that. A stronger research story would have helped.

Customer love

We had happy clients but not enough proof. Surveys, testimonials, NPS data. All of it would’ve made the “Why Sarwa” slide more compelling.

What did land well

✅ Our thinking around customer acquisition: how we planned to scale channels

✅ Product strategy: bold bets, clear roadmap (although most of it changed), and the discipline to ship

✅ Capital efficiency: we knew how to stretch a dollar

What I’d tell my past self (or any founder raising now)

Keep it simple

Keep venture deals as straight cash and equity. Strategic deals can happen before/after but unbundle them.Never “kind of” raise. Either go all in or don’t do it. Have one co-founder full own it and doing just that. Fundraising half-heartedly drags your team, your energy, and your metrics down.

Expect it to be stressful, and expect diligence to be worse. The real work starts after the handshake.

Do reference checks on VCs. If they’re newer to investing, you might be part of their learning curve. That can mean slower processes and a team still figuring out how they work best, so plan accordingly.

It took longer than expected, and it was messier than we hoped. But we walked away with a strong cap table and partners who’ve had our back since.

And with time, this round aged really well.

Beyond bringing on a strategic with a long-term view, the real win for me was getting the chance to work with Joe Kawkabani who led the deal. He is now CEO of OSN and then CIO of KIPCO, and a Sarwa board member. Joe has been more than a mentor. He showed up in every hard moment at Sarwa.

He’s cool-headed yet intense in how much he cares. He leads by trusting deeply and holding the bar high. I’ve learned more about leadership from him than from any coach or book. Having someone like that in your corner makes all the difference.

Full deck’s at the bottom.

Here’s a quick preview of a few slides.

📊 Download the full deck

👉 View the Series A pitch deck here See the full slides that helped us close the $8.4M round.